Chris Ross – Tenerife Insurance – Highly Recommended

Chris offers the following types of insurance:

- Accident Insurance

- Bar/Restaurant Insurance

- Boat Insurance

- Car/Motorbike Insurance

- Community Insurance

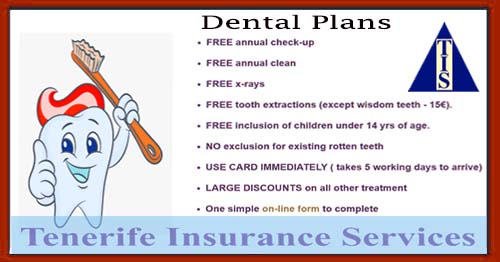

- Dental Insurance

- Funeral Insurance

- Health/Medical Insurance

- House Insurance

- Life Insurance

- Pet Insurance (Cats – Dogs)

- Public Liability Insurance

- Savings / Investments / Pensions

- Travel Insurance

Chris Ross – Health Insurance – Highly Recommended